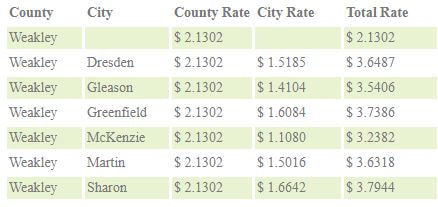

Weakley County Property Tax Rates

The information below was retrieved from the State of Tennessee Comptroller's Website.

Rates As Of June 2013

Property Tax Calculators

Now you can calculate your own property taxes by using the property calculators below. Remember that if you are calculating taxes for a residential or commercial property within the city limits, you are also responsible for payment of city taxes. City tax payment amounts are not included in the calculated amounts below. For help calculating your city taxes, please call your local City Hall for resources and assistance.

The assessed value of property is a percentage of the appraised value. The percentage used is based on the property's classification:

► Residential = 25 %

► Commercial = 40 %

► Industrial = 40 %

► Personal = 30 %

► Farm = 25 %

Contact the Weakley County Assessor's Office for any questions on property classification.

Disclaimer: These tax calculators are for informational purposes only, please see the Weakley County Property Assessor to confirm exact tax amount.

The assessed value of property is a percentage of the appraised value. The percentage used is based on the property's classification:

► Residential = 25 %

► Commercial = 40 %

► Industrial = 40 %

► Personal = 30 %

► Farm = 25 %

Contact the Weakley County Assessor's Office for any questions on property classification.

Disclaimer: These tax calculators are for informational purposes only, please see the Weakley County Property Assessor to confirm exact tax amount.